Swiss automotive industry 2018: saturation effects

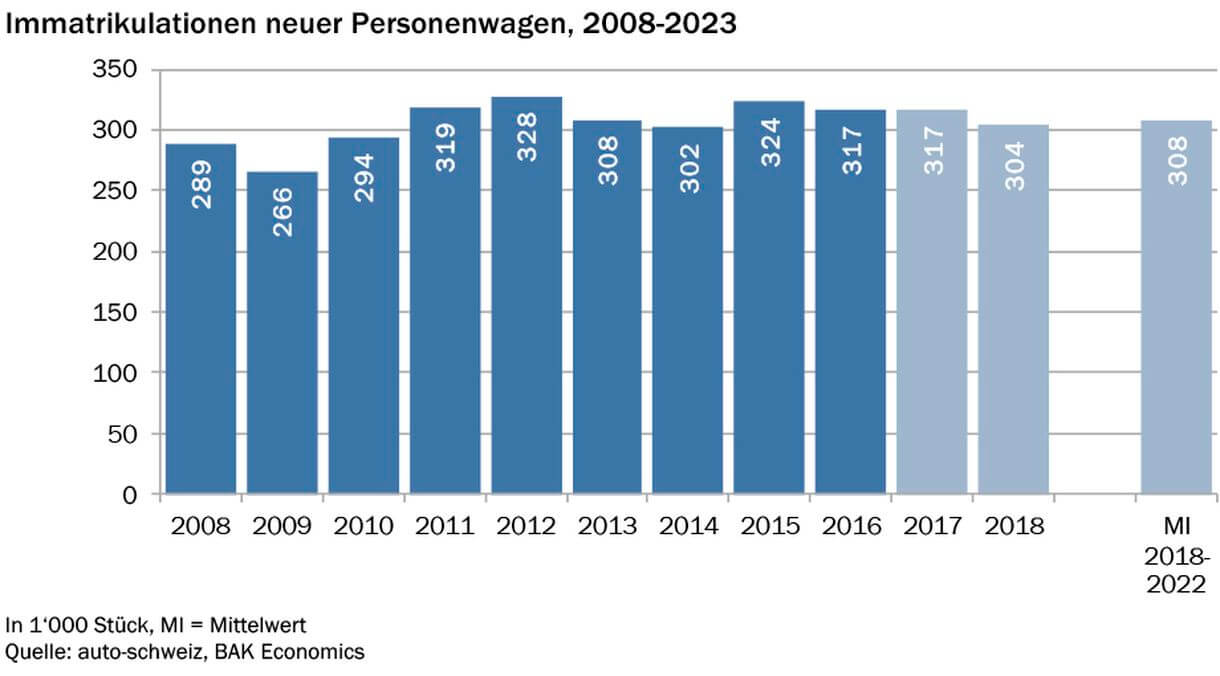

AGVS BAK Economics forecasts 317,000 new vehicle registrations for 2017. However, due to saturation effects and advance purchases, a correction of 4.2 percent to 304,000 new registrations is expected for 2018. Through August 2017, prices of newly registered passenger vehicles fell another 2.2 percent on average. However, the recent depreciation of the Swiss franc points to [...]

By August 2017, the prices of newly registered passenger cars had fallen again by an average of 2.2 percent. However, the recent depreciation of the Swiss franc points to rising prices or at least to the elimination of attractive euro discounts.

Saturation effects expected

With an expected decline of 4.2 percent, 304,000 new registrations are still expected in 2018. On the one hand, the market had already responded to initial saturation trends in 2013 and 2014 with declining new car purchases. However, this development was abruptly reversed by the minimum price increase in 2015. It can be assumed that such saturation effects will consolidate again next year. For 2018, BAK also expects a significant depreciation of the Swiss franc towards an exchange rate of 1.18 EUR/CHF.

Nevertheless high level

Nevertheless, enrollments remain at a historically high level in the expected bearish phase in 2018. The upturn in economic growth expected by BAK next year should have a supportive effect on the automotive sector. For the used car market, BAK forecasts a decline of 1.8 percent in 2018 (855,000 changes of hands). The supply-side momentum from used vehicles, which have flooded onto the market as a result of the replacement purchases of new cars made in recent years, is likely to gradually subside. In the medium term, however, the used car market will benefit from the expected inflation in the new car segment.